- Home

- Own Branded Videos

- About Own Branded Videos

- Our Videos – For Advisers

- Our Videos – For Accountants

- Inspiring Financial Ideas Video Series

- Inspiring Financial Ideas Video Series

- Inspiring Financial Ideas – Video Series Terms

- What is Socially Responsible Investing?

- The Importance of Understanding Sequence of Returns

- Why Longevity Matters

- Relevant Life Plans

- Start Saving Early and Pay Yourself

- Financial Planning

- Using Trusts with Life Policies and Pensions

- Pound Cost Averaging Explained

- IHT Video Series

- Why Video

- Online Positioning

- Guides

- Our Sites

- Other Services

- More Info

- Home

- Own Branded Videos

- About Own Branded Videos

- Our Videos – For Advisers

- Our Videos – For Accountants

- Inspiring Financial Ideas Video Series

- Inspiring Financial Ideas Video Series

- Inspiring Financial Ideas – Video Series Terms

- What is Socially Responsible Investing?

- The Importance of Understanding Sequence of Returns

- Why Longevity Matters

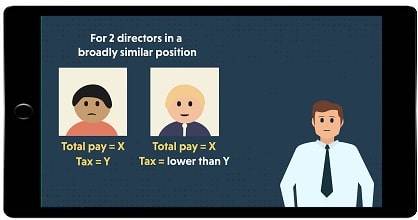

- Relevant Life Plans

- Start Saving Early and Pay Yourself

- Financial Planning

- Using Trusts with Life Policies and Pensions

- Pound Cost Averaging Explained

- IHT Video Series

- Why Video

- Online Positioning

- Guides

- Our Sites

- Other Services

- More Info